Last Updated: August 10, 2017

Create a budget. Get out of debt. Start traveling!

To which I earn a small commission, at zero cost to you!

Find more info in our Privacy Policy.

Maybe I’ve been watching too many Dave Ramsey YouTube videos, or the realization that we are moving back to Canada next summer and actually have to pay things like rent and utilities is finally starting to sink in. Either way, our short-term travel goldmine is coming to an end and we need to start #adulting. Throughout all of the debt-free books, they all have the same underlying message; you need to be out of debt and financially secure before you can buy the big things like a yacht or travel the world. They differ, however, on how much “fun” you are allowed to have while you are working away at paying off this debt and growing your wealth in order to buy the things you want/need.

Ask the experts

While each expert has their own way of describing how to do it, they each get you there the same basic way. Dave’s steps, however, are the most concise that I have seen so far. The Wealthy Barber, on the other hand, gives great life lessons on WHY you need to accomplish these tasks, discusses “better late than never” and does it in a story-telling way. Honestly, I finished this book in 2 days and marked it all up with highlighter and pen notes. But I learned, and that’s what matters.

Dave Ramsey offers 7 baby steps to concurring your debt and getting what you want, in a timely fashion. It is important to take each step one at a time. As humans, we are defensive of change and like what we have going on right now, even if what we have isn’t working for us – it is still ours. The first baby step is the hardest and the easiest to accomplish, giving you that motivation to continue.

What does any of this have to do with budget traveling

Traveling with a heap of debt is no fun. Trust me. We opened a line of credit to fix the house but used the money from selling the house to pay off my student bank loan that my dad co-signed. I mean, it had been 10 years and he wanted to buy a bigger home of his own; my lack of financial responsibility was literally affecting his buying potential. This is also why you never co-sign for anyone. That one month when I forgot to pay my bill, he got charged a few days later with a late fee. That was not a happy phone call I received that night. What I am trying to say is, traveling with debt isn’t high on the list of smart choices we have made over the years.

There are times, however, when travel is … how do I say this without sounding completely stupid…. unavoidable. I mean, honestly, I moved to freakin’ Europe for 4 years. What else was I going to do! Pay my debts off in the first year, for starters.

What does having debt while travelling looks like? Like a rat race, that’s what it looks like. You pay down your credit cards, ’cause you still owe plenty on them but only have so much disposable income (problem #1, don’t carry a balance, ever). Then you go on vacation – but because you spent all your money on paying your Visa, you use your Visa to pay for the hotel. You see a pattern here? When the statement comes in at the end of the month, you are right back where you started; Maxed out Visa and nowhere closer to being debt free. But you spent two weeks in Rome so at least you did that. Right?

Wrong! At a modest 12% interest rate on your Visa, you will be paying off Rome until that card is paid off.

All work and no play…. sucks

Gail Vaz Oxlade disagrees a little with Dave Ramsey in how he prioritizes gratification. People want to go to the movies, eat out, travel… actually leave the house. If you plan on travelling, Gail suggests incorporating your travel expenses into your budget from the beginning. The same rules apply, however, no spending on credit and only what you can save for. This means your debt will take a little longer to pay off and therefore incur that much more interest. Keep in mind, though, the cost of travelling isn’t only about the flight and the hotel; some may require a heap of purchases.

How important is it to travel? Can it wait until Steps 1-6 are fulfilled or does it need to happen during Step 2? Because until you have an emergency fund, you shouldn’t be doing much of anything. And your mom doesn’t count as an emergency fund – she has her own set of expenses to take care of.

How to save and budget for traveling

I am looking at a trip to Walt Disney World and touring Asia too, well, tour Asia, and visit all 3 Disney locations (there is no helping me, we are a Disney family). So I will use these future trips as an example of how to save money for travelling.

First, I have joined WAY too many Facebook groups. Non-Disney locations have just as many groups – mostly run by tourism offices, travel agents, and the local blogging expert. Find those pages and groups, and join. They will ask so many questions you didn’t even know you needed to ask. Write them all down.

Second, visit those travel websites. Either research your own or ask the groups which sites they prefer to use in order to plan their vacation. For the groups run by brands, ask them for their sites as well as their competitors – transparency. Those sites will help find hotel recommendations, things to do (paid and for free), tour guides and best times to visit.

Third, research offseason. Some locations don’t change much between on and offseason, in terms of business hours, like Disney. Others, like the French Riviera, almost shut down when the crowds start to get low. Since the cost of flying and staying at your destination will be significantly cheaper during the offseason, it is definitely something to think about. Not only can you do more with what you have saved, but you can also visit sooner since not as much is needed to be saved.

Fourth, create a mock itinerary including prices. That is your goal. Disney is currently going to cost 10k without any discounts or Air Miles. This is my tentative goal. When do I want to visit; when the baby is 10 years old. So now I have 8 years to save 10k… but I also need to save for a new car (since ours is already 10 years old), and the kids will need braces and we all know those aren’t cheap. I need to save $1,250 USD plus inflation in order to visit Disney in cash. The more Air Miles I collect, and more travel hacks I can accomplish, the less I will need to spend for my vacation. I can either take my savings and cut down my overhead, use it for spending money, or upgrade my reservation.

Fifth, join even more Facebook groups – budget traveling or travel hacks. Air Miles are a tricky little thing to keep track of; who has the best deals, how to buy things with your miles, is buying $150 worth of soup to save $300 on tickets worth all that time and effort (yes, and the food bank gets a great donation… is that tax-deductible?).

Why you can’t destroy your credit cards

This goes against everything the experts say, but for good reason. Hotels need a credit card to guarantee the room, even if you pay cash. Air Lines need a credit card to make the reservation.

You could use a prepaid credit card to make purchases since it is still in line with budgeting, but just like any gift card – your money is stuck on that card until spent. If you change your mind, get a refund, or it becomes cheaper than expected, your money is locked on the card.

What is travel hacking?

No, you aren’t hacking government servers and stealing free vacations. Essentially, you are using the cards to their full potential. Take Air Miles, for example; the other day I heard someone got 980 Air Miles for buying $120 worth of St Hubert canned soup. Well, that is half of a 7-day standard pass to Walt Disney World. So instead of paying $530 (currency exchange and taxes), she will pay $240 for the exact same product. Log into the Air Miles website and cash in your purchases. The LCBO offers Air Miles on everyday purchases, and so does Foodland so if you don’t have $240 laying around, just make your purchases at participating locations.

Another form of Travel Hacking that many people use is reward points or cash back with their credit card. This is for seasoned budget-ers only, as the temptation is too great. Get yourself a great credit card – reward miles that transfer to flights or car rentals, or cash back cards that literally reward you with cash in your account every November. Both cards have a hefty interest rate, which is why we don’t carry a balance, and an annual fee (per card holder) so the rewards need to outweigh the negatives. Make EVERY SINGLE PURCHASE on these cards, according to your budget, then pay it off once the statement comes in. This will keep your account clean, your finances in order, and the rewards on your side. This is my parents’ preferred method of traveling and they receive a single person return ticket from Toronto to Germany free of charge, once per year. Mind you, the other 3 vacations they take are also on their card so they have ample opportunity to rack up those points.

Why for budgeting pro-stars? Because once you start using that card, and still see money in the account, it’s easy to spend both your cash and credit. Have a system in place where you can write down exactly what has been spent, from which category, and how much you have left for the month. A running tally.

Dave Ramsey’s 7 Baby Steps

1. $1000 emergency fund (if earning less than 20k/yr, make is $500)

Shit happens, and we can’t be using our credit cards to fix it. Get an emergency fund so when things do break, you have that cash sitting there. $1000 isn’t that much, but it is just the start while you get your debts in order.

This also applies to travelers – just because you can afford a plane ticket and have a job lined up somewhere, doesn’t mean you should just up and leave. Too many times I hear on Facebook of solo travelers being kicked out of the Couch-surfing accommodations early (or canceled the night of, ’cause people suck that way) and they can’t afford a single night in a hotel until they figure it out in the morning. This is not only foolish but dangerous. ALWAYS have an emergency fund, especially when traveling.

2. Debt Snowball.

Like any snowball, it gets bigger and bigger the more it rolls. List your debts from least owning to most owning. This is also a motivational task – by accomplishing the little debts first, you get a taste of accomplishing the tasks and seeing those debts wiped clean. Next to the debt amounts, list their minimum payments. During the Zero Balance Budget, you will be paying the excess on the top debt and minimums on the remaining. Once the top is paid off, take that amount and pay down the next, until you have reached the bottom of your list.

In theory, your rent should only be about 1/4 of your income, leaving the rest for necessities, wants and debt. Depending on how much you owe (outside of Student Loans), they average that it should only take about 2 years to payoff. If your home costs more than this, then it is time to consider your options. Anything over 2 years starts to feel fruitless and can negatively impact your chances of completing the tasks. Gail Vaz-Oxlade would suggest getting a consolidation loan to lower the monthly payments, negotiate the interest rate.

2b. Zero Balance Budget

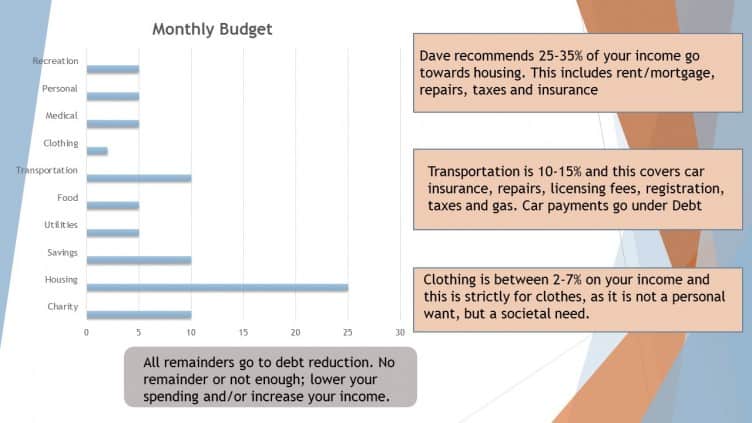

A Zero Balance Budget is exactly what it sounds like; after paying for Food, Utilities and Rent, Gas, Auto Insurance, Life Insurance (you need this) and Entertainment (packet money, cell phone, cable, internet…), everything left is for debt reduction. Take your minimum payments for this equation and subtract everything from your total household income. There should be a few dollars left over. This leftover amount now attacks the least owing debt until it is paid off, then that amount attacks the second debt on the list.

As a Godly man, Dave has 10% income set aside for charity. Since I am not, I do not have that column.

Every single penny needs to be accounted for and placed in a category. All 3 experts agree that these monies need to be placed in an envelope or jar to be spent every month, and once the money is gone – it’s gone. You can’t borrow money from one jar to pick up the slack in another. If this is required, then the budget needs to be looked over again, or your spending needs to be checked.

3. 3-6 months of expenses in the savings account.

Now that you are debt free, because we do one step at a time, not at the same time, you can start saving for those larger emergencies. The loss of a job, out of pocket medical situations (yes, this also happens in Canada – not as often as America, but it happens).

Take all that money you were using to attack the debt, and shove it in that savings account. It needs to be somewhere you can’t easily spend it, like the sock drawer, but can be accessed without much hassle – and with no fees attached to withdrawals. This is not money to be invested – it is insurance. The key is, to never touch it. Once you have an emergency fund, things are no longer an emergency – they are a mere inconvenience i.e. the car cost $5,000 to fix, but you have 10k in the bank; no problem! Your day to day routine is barely affected, vs before when the world was ending because your 20-year-old car needed $200 worth of work.

4. Invest 15% of income into a Retirement Plan

According to many studies, most people believe they will be better off once they retire but have made zero plans for that retirement. CPP will not make you rich – it barely keeps up with the cost of living. Slowly save for retirement now and it will be so ingrained into your budget, that you won’t even know that money is missing.

What you will notice, though, is that once you hit 65 and CPP does start to roll in, you are actually able to do something with your day. I have a sneaky suspicion that grandma isn’t working Walmart People Greeter because she wants staff discount; she is supplementing her income because her current retirement plan isn’t good enough.

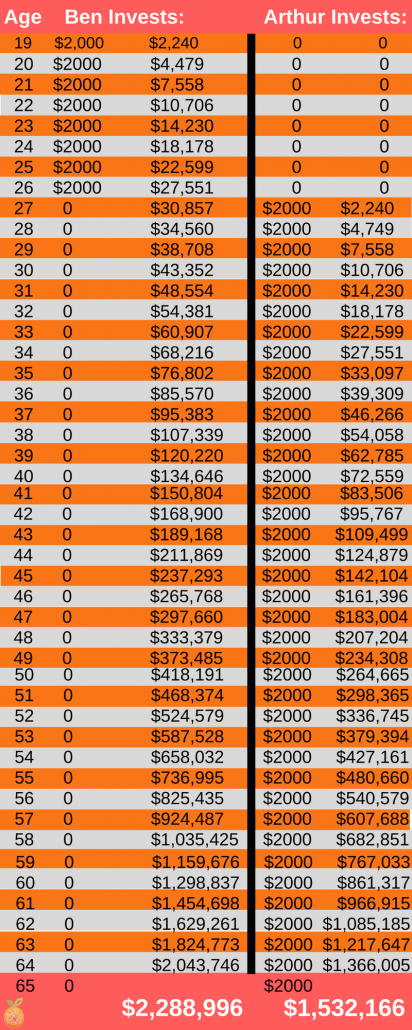

All 3 experts mention Ben and Arthur, so it’s safe to assume these two guys are a pretty good example of starting early. While we can’t go back in time and change our passed financial choices, we can start fresh now and “better late than never” comes to mind. This is also a great way to explain to your kids why starting early is a great idea – even if you have to force them.

This is also the time you are going to start saving for those expenses instead of charging them to your card, or making monthly payments with interest. While many companies offer 12 months no interest, no payment – unless you pay them off before your due date, you will incur all that backdated interest. Dave suggests his Sinking Fund approach. This is when you personally save up each month for that item, then pay for it in cash. Others believe that using the 12 months no interest is only useful if you make direct withdrawals for those monthly payments during those 12 months so there is zero chance that you are overdue – since you will pay interest on the whole amount if you are even $1 overdue. Dave also believes that you will attract better deals from these businesses if you show up with hard cash, instead of credit cards (which cost them fees) or payment plans. What if they don’t give you a cash discount – don’t do business with them. There are plenty more used car dealerships or furniture stores that one is bound to see it your way – just don’t get too crazy with the demands.

Dave also believes that you will attract better deals from these businesses if you show up with hard cash, instead of credit cards (which cost them fees) or payment plans. What if they don’t give you a cash discount – don’t do business with them. There are plenty more used car dealerships or furniture stores that one is bound to see it your way – just don’t get too crazy with the demands.

The other perk of paying cash instead of payment plans is that you can choose to reconsider your purchases before the money is spent. You have worked so hard and long for that cash in your hands, do you really need another sofa, or is the one you have still good? Same goes for travel – do you really want to fly here for a week or can you save a little longer and spend 2 weeks at your destination – or at a better destination.

5. College fund for the kids

Step 4 and 5 are meant to be done at the same time. While you are saving 15% for retirement, make a plan for college and keep the rest for future spending.

Setting the kids off on the right path is how you can help prevent them from going down the same slippery slope of student loans that many are struggling with at the moment. This doesn’t mean they get a free ride; they can still be expected to work during the summer, pay their own rent and groceries – but the bulk of the payment, the tuition, is taken care of.

Don’t have kids, great – skip this step. Have a ton of kids, this will take a little longer to accomplish. Now, their whole 4 years doesn’t need to be paid for in cash, on their first day of school. It is possible to only have part of the child’s tuition in the bank when they start, as long as Year 4’s bill is paid for by the time they finish Year 3. Same goes for subsequent children – pay one off before starting another child’s fund if you are starting late. Bun in the oven – perfect! Start by making small, $2,000 per year investments into a Registered Education Savings Plan. Dave talks about 12% interest a lot, and they do exist, so don’t take the first quote as law. Keep looking. At 12% , that investment will turn into 126k in 18 years – plenty for 3 kids (depending on inflation of course, so let’s say 2 kids just to be safe)

6. Pay off the House early

Think of all the things you could do with your life when you no longer have to save for college, an emergency fund or pay your mortgage. The possibilities are endless.

Now, why do they all push for homeownership instead of renting – simple; renting pays buddy’s mortgage and you get zero out of it. If you want to travel, rent the house out and take that added income to subsidize your travels, or sell it and use your profits for travel. But nothing comes from being a renter, other than lower overhead and lack of responsibility (wait, am I trying to convince you to buy or to rent…)

If you already have a home or plan on buying in the future, this is for you. Experts suggest a 15-year mortgage with fixed rates, and your monthly bill should not be more than 1/4 of your income.

7. Build Wealth

This is the fun part – your emergency is stashed away, your kids are in college, your house is free… now what?

TRAVEL! Do whatever you want. This is where The Wealthy Barber comes back into play. He discusses how to invest your money for the maximum return, both short and long-term, which purchases are actually an investment in disguise – like real estate – and what to do when you just have too much money and don’t know what to do with it anymore.

Stay out of debt

So that was getting out of debt. While it seems like a total bore, it is a necessary evil. The Wealthy Barber explains what happens to your debt should something happen…it goes to your estate and whoever is left in charge of it. I have no interest in leaving this world and have my parting gift to my children be thousands of dollars in the negative. Get an emergency fund, pay off that debt, Send the kids to school and start saving for retirement. Then and only then can you truly enjoy your vacation without worrying about money.

You May Also Like…

- Travel isn’t just about photos and souvenirs.

- When saving money can cost you valuable time

- Travel Hack your way to 6 Disney Locations in 6 Months